Place out purposes. Stay away from a number of loan applications in a brief interval, as This will lessen your credit score rating and make lenders cautious.

Borrow responsibly. Only choose out a personal loan Should you be confident you could repay it promptly to prevent financial debt traps and likely default.

Influence on your credit may perhaps change, as credit rating scores are independently determined by credit score bureaus depending on numerous factors such as the economic selections you make with other economic companies organizations.

It’s probable to have a personal personal loan for those who’re 18 years outdated and have no credit rating record — Everybody’s gotta get started somewhere!

Our partners can't shell out us to ensure favorable opinions in their items or products and services. Here is a summary of our associates.

Finder.com is definitely an unbiased comparison System and information provider that aims to provide you with the instruments you have to make superior decisions. Even though we've been independent, the delivers that surface on This website are from corporations from which Finder receives compensation. We might receive compensation from our companions for placement of their products or companies. We might also acquire compensation when you click selected links posted on our site. Although compensation arrangements may well influence the get, posture or placement of item details, it will not affect our assessment of These products and solutions.

It’s also frequent for teenage borrowers to possess a cosigner on their own to start with vehicle bank loan, commonly to increase approval odds or to get a reduced desire rate.

"Your credit history score impacts your capability to have a personal loan, the curiosity fee you spend, your capability to get an condominium and occasionally even your capability to land a position," says Brian Walsh, a Licensed economical planner and head of recommendation and planning at SoFi. Even with its great importance, however, youthful Grown ups typically study credit score by trial and mistake.

At 18, stepping in the financial entire world with a bank loan might be a wise go for your personal potential. There are actually particular loans that cater to younger Grown ups just setting up.

Some monetary establishments give these tiny, shorter-term loans made specifically to help you youthful Older people Develop credit rating.

Restricted Bank loan Amounts. Getting 18 frequently indicates restricted or no credit rating record. As mentioned higher than, you may qualify for a comparatively smaller bank loan quantity, which could not go over your greater expenses.

On the other hand, Take into account that in case you fail to repay the financial loan, the lender has the correct to take possession with the collateral. So, It really is vital to borrow responsibly and make your payments promptly.

Furthermore, whenever you do desire to borrow income for a home, an automobile or another reason, your credit history more info will identify the desire charges you pay – or no matter whether you are accepted in any respect.

The more you delay, the worse the situation could get. Most lenders will consider restructuring your financial loan payments or postponing a payment.

Rick Moranis Then & Now!

Rick Moranis Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Erik von Detten Then & Now!

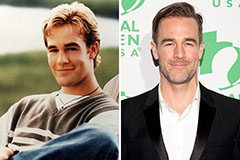

Erik von Detten Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now!